College is more expensive than ever. If you’re feeling the financial squeeze, you’re not just imagining it. The average annual cost for a U.S. college student now hovers around $38,270, a figure that has more than doubled since 2000, far outpacing inflation.

This isn’t just a numbers game; it’s a source of real stress for students nationwide. But here’s the good news: while you can’t control tuition hikes, you can control how you manage your money. This is your survival guide – a practical toolkit to help you navigate rising costs, build a smarter budget, and not just survive, but thrive.

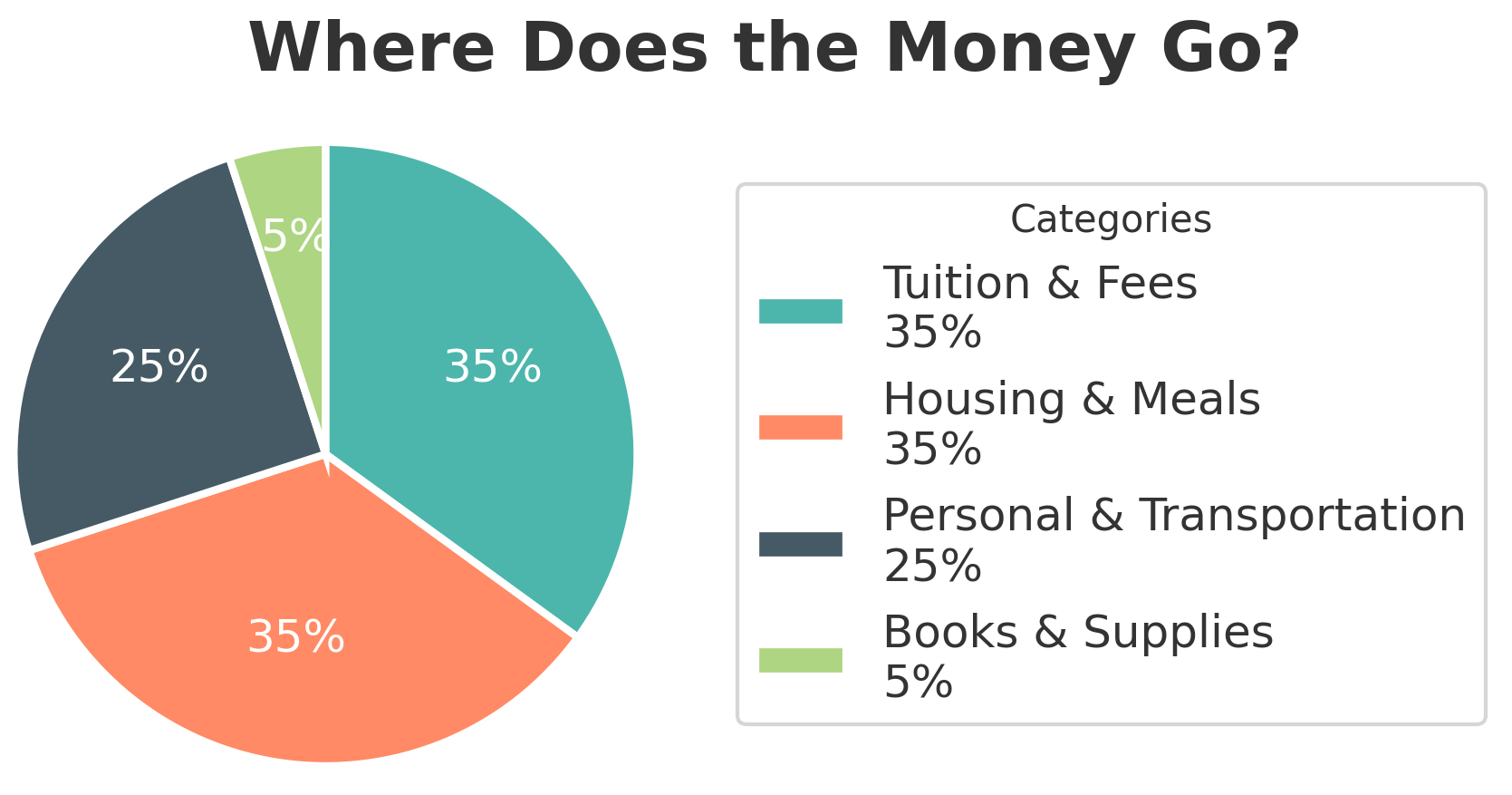

The Big Picture: What Are You Actually Paying For?

Understanding where your money goes is the first step to taking control. Here’s a breakdown of the major expenses every student faces.

1. Tuition and Fees: The Main Event

This is the largest expense for most students. For the 2024-25 academic year, the average published tuition and fees are:

- Public University (In-State): ~$11,610 per year

- Public University (Out-of-State): A staggering ~$30,780 per year

- Private University: Often exceeding $43,000 per year

How to Save on Tuition:

- Don’t Pay the Sticker Price: The published tuition is rarely what students actually pay. After grants and scholarships, the average net price is often significantly lower. Always fill out the FAFSA – you might qualify for more aid than you think.

- Graduate On Time: Extra semesters mean extra tuition bills. Taking a full course load or even summer classes (which can sometimes be discounted) can save you thousands in the long run.

- Explore Payment Plans: Most colleges offer monthly payment plans, allowing you to spread out the cost instead of paying a huge lump sum each semester.

2. Housing and Meals: Your Home Base

After tuition, room and board is the next biggest chunk of your budget, averaging $12,000 to $14,000 per year. Whether you’re in a dorm or an off-campus apartment, these costs add up fast. How to Save on Housing:

- Live with Roommates: This is the #1 way to cut down on rent. Splitting a two or three-bedroom apartment is almost always cheaper than living alone.

- Become a Resident Assistant (RA): If you’re an upperclassman, becoming an RA can get you free or heavily discounted housing in exchange for supervising a dorm floor.

- Cook Your Own Food: A full university meal plan can cost over $500 a month. Learning a few simple, cheap recipes (pasta, stir-fries, chilis) and cooking at home can be significantly cheaper and healthier.

3. Textbooks and Supplies: The Hidden Costs

New textbooks can cost a fortune, with students spending an average of $1,200 per year on books and supplies. But you should never have to pay full price. How to Save on Textbooks:

- Rent, Don’t Buy: Services like Chegg or campus bookstores allow you to rent textbooks for the semester at a fraction of the purchase price.

- Buy Used or Go Digital: Used books can be 50% cheaper. E-books are also often less expensive than their print counterparts.

- Check the Library: Your university library likely has copies of required textbooks on reserve for short-term checkout – for free!

4. Transportation and Personal Expenses: The Budget Leaks

Gas, public transit, cell phone bills, entertainment, and that daily coffee can quietly drain your bank account, often adding up to over $3,000 a year. How to Save on Everything Else:

- Use Your Student ID: Your student ID is a golden ticket. It gets you discounts on software, streaming services (like Spotify and Amazon Prime), movie tickets, public transit, and even clothing. Always ask if there’s a student discount.

- Leverage Free Campus Resources: Your tuition often covers access to a gym, counseling services, career workshops, and tutoring centers. Use these instead of paying for private alternatives.

- Master the “Latte Factor”: Small, frequent purchases add up. Making your coffee at home or packing a lunch instead of buying it on campus can save you hundreds of dollars over a semester.

Your Financial Aid Lifeline: Don’t Leave Money on the Table

Financial aid is your most powerful weapon against rising costs. The goal is to maximize “free money” (grants and scholarships) to minimize loans.

- File the FAFSA, Every Single Year: The Free Application for Federal Student Aid (FAFSA) is your gateway to grants, work-study, and federal loans. Fill it out as soon as it becomes available each year, even if you think you won’t qualify.

- Apply for Scholarships Relentlessly: Billions of dollars in scholarships are available. Use search engines like Fastweb and Scholly, but also check with your college’s financial aid office for department-specific awards. Even small $500 scholarships add up.

- Take Advantage of Federal Work-Study: If you’re offered work-study, take it. It’s a part-time job (usually on campus) where your wages are subsidized by the government. It’s a great way to earn money without affecting your future financial aid eligibility.

Budgeting 101: Taking Control of Your Cash Flow

A budget is not about restriction; it’s about empowerment. It’s a simple plan that tells your money where to go, so you don’t have to wonder where it went.

Your Simple 4-Step Budgeting Process:

- Calculate Your Monthly Income: Add up everything you have coming in – financial aid refunds, job income, family support, etc.

- Track Your Expenses: For one month, write down everything you spend money on. Use a notebook or a budgeting app like Mint or YNAB. This will reveal your spending habits.

- Create Your Plan: Set spending limits for each category (e.g., $250 for groceries, $75 for fun). Your goal is simple: Income – Expenses = $0 or more.

- Adjust and Stick to It: Your budget won’t be perfect the first time. Adjust your limits as you go. The key is to be intentional with your spending.

| Sample Student Budget | Monthly Amount |

| Income (Job + Aid Refund) | $1,200 |

| Rent & Utilities | $550 |

| Groceries & Food | $250 |

| Transportation | $75 |

| Books & Supplies | $50 |

| Personal & Fun | $125 |

| Savings/Emergency Fund | $100 |

| Total Expenses & Savings | $1,200 |

| Remaining Balance | $0 |

Thrive, Don’t Just Survive: Your Financial Game Plan

The rising cost of college is a real challenge, but it is one you can meet with smart planning and resourcefulness. Embrace a frugal mindset, seek out every dollar of financial aid, and create a budget that works for you.

As one student who successfully managed their finances put it, “Learning to budget in college was the most valuable skill I acquired, even more than my major.”

Take that advice to heart. By graduating with strong financial habits and minimal debt, you are giving your future self the greatest gift possible.